Wow, what a year. It started out like a smooth sail, but somewhere along the way, the waters got choppy- markets swinging like a pendulum on caffeine.

Honestly, I’ve not been glued to the charts. Work’s been full-on, and I only recently caught wind of the latest tariff news. A friend asked me if I panicked. But truth is, I didn’t. Not because I’m some seasoned expert or anything, but I’ve come to see dips as quiet invitations to stay calm and stick to the plan.

I just keep it simple—some dollar-cost averaging, and when the market dips hard, I’ll place a few buy limit orders overnight. If they get filled, great. If not, I cancel and try again the next day. It’s not glamorous, but it works for me. Like tossing fishing lines and seeing if the market bites.

Right now, I’m on a short break—flying to London shortly and transiting to Croatia with a colleague. Sitting in the lounge, soaking in a moment of rest. I don’t take these for granted.

Wishing everyone a steady week ahead. May we all stay grounded, ride out the waves, and if you spot a good deal—don’t be afraid to nibble. Huat ah!

Refueling with a hearty bowl of pork bone ramen at the ski field for lunch—nothing beats this after carving up the slopes! Legs are feeling pretty sore though, not surprising after skiing consecutively for the past few days. Hope everyone’s doing well

New year, new slopes! 🏔️ Kicking off 2024 with my first ski—fully geared up and ready to conquer the snow. Let’s make this year as smooth as carving through powder.

Hello! How's everyone doing? Having a Japanese lunch break at Teine mountain after skiing.

Wishing everyone a huat year to end 2024 and a great 2025!!

With the first sip of champagne, it feels like the sun dares to shine a little brighter, as though the universe is giving me permission to pause, breathe, and find a moment of calm. This year has been a rollercoaster—full of unexpected emotional twists, steep drops, and fleeting highs—but in this glass, there’s a quiet kind of celebration. Not of perfection, but of resilience.

So here’s to the little victories, the lessons learned, and the hope that tomorrow brings a steadier ride. Cheers to moving forward, one sparkling sip at a time.

I’m taking a short break to Tokyo and Hokkaido—Tokyo for some amazing food and Hokkaido for skiing. I’ll also be meeting a friend there. It’s been a rollercoaster of a year, with plenty of emotional challenges, but I’m hoping to come back feeling refreshed and recharged after this trip. I will be posting photos of good food too! 😋

On a brighter note, the stock market has been kind this year. Wishing everyone a Merry Christmas and a Happy New Year! Here’s to a great 2025, with STI and $NASDAQ(^IXIC.IN) breaking new highs. Huat ah!

A Year of Growth and Conviction

2024 has been a year of growth, milestones, and strengthened conviction—both in my investments and in my approach to life. Each step forward has been like adding pieces to a puzzle, bringing me closer to the bigger picture of my goals. This year has been a pivotal one in my journey toward FIRE (Financial Independence, Retire Early) by 40, as I am now 55% of the way to my target of $3.9 million.

Reflecting on this progress, I’ve learned the importance of focus and discipline—whether it’s simplifying my portfolio, making sharper decisions, or staying committed to long-term goals. While I’m determined to achieve my FIRE target, I recognize the road ahead will not always be smooth. Volatility is inevitable, but I view these market fluctuations not as obstacles but as stepping stones—opportunities to invest in high-conviction stocks that will ultimately help me grow my assets for the long term.

Net Worth Update

I’m excited to share that my net worth has grown to $2.17 million, with a remarkable $170,000 increase in the last month alone, thanks to Tesla’s stellar performance. What’s even more striking is that a significant portion of these gains materialized in just the first two weeks of the month, a rapid ascent that felt like watching a spark turn into a blaze.

While the surge may appear sudden, it’s a culmination of months of preparation and conviction—staying the course, holding through volatility, and trusting in the long-term potential of my investments. It’s a reminder that, in investing, some of the most rewarding moments often come in bursts, fueled by the groundwork laid well in advance.

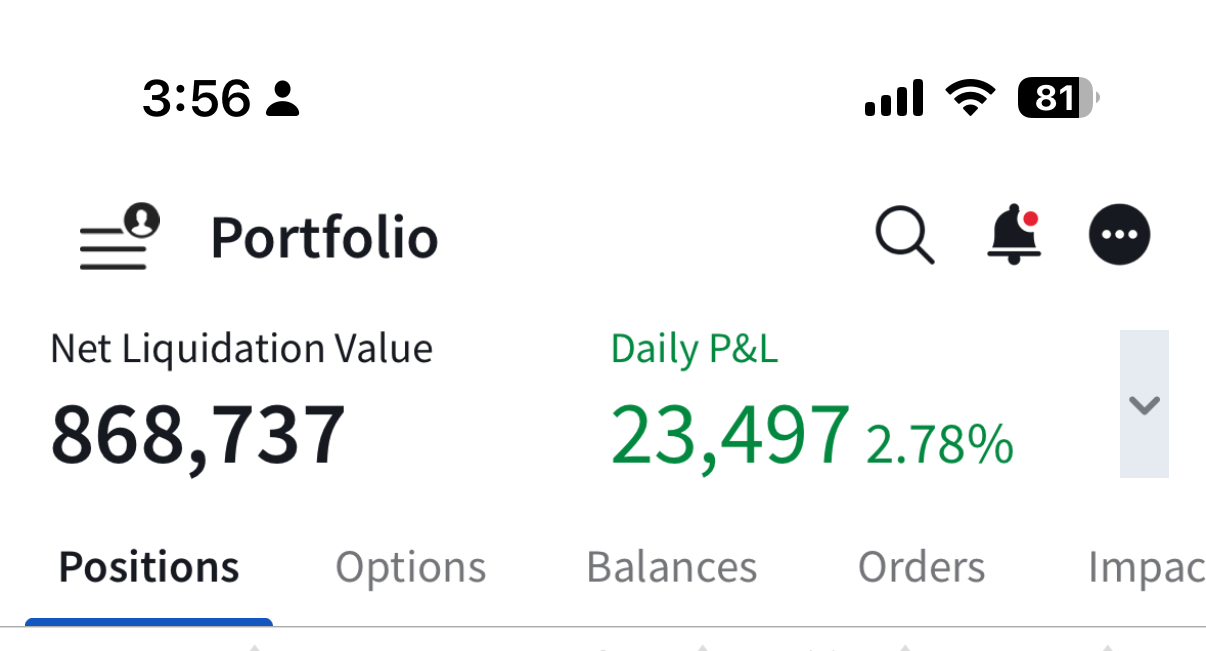

Here’s how my portfolio currently looks:

• Stock Portfolio: $874,600 (a $100,000 increase this month, led by Tesla).

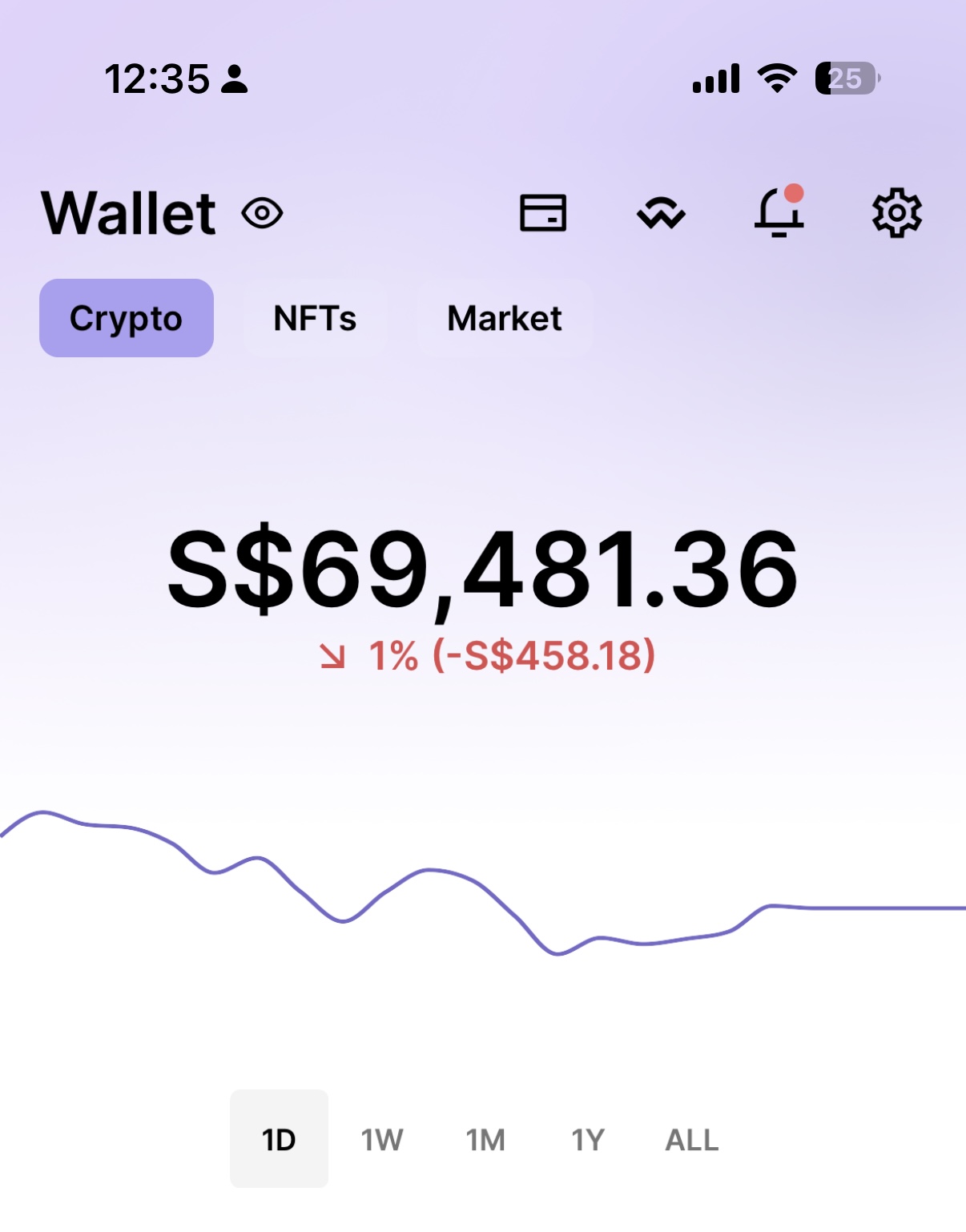

• Crypto Portfolio: $69,000 (100% appreciation over the year).

Screenshot

Screenshot

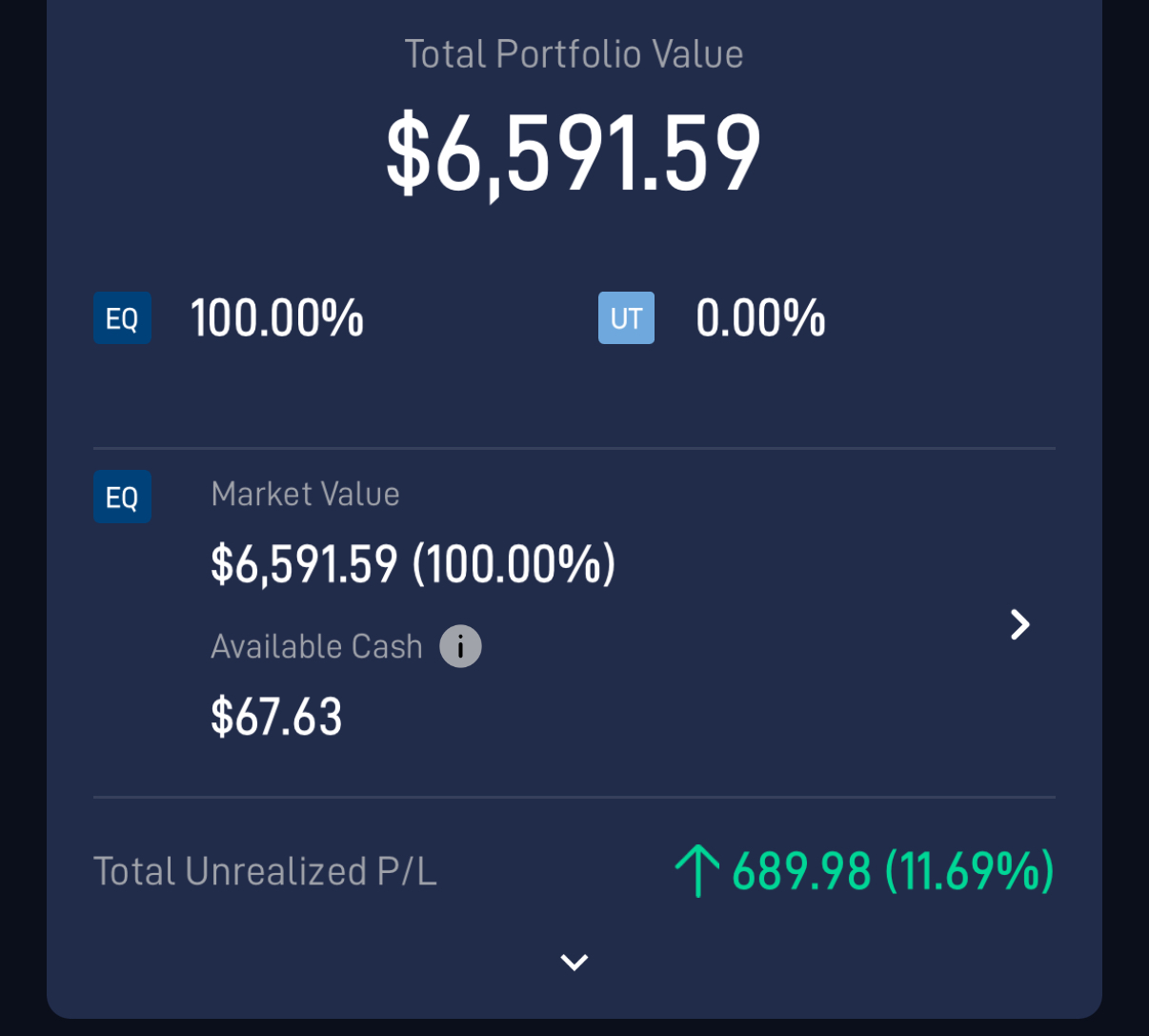

• SRS Account: $57,000 (growth without additional injections).

• Property Value: $1.29 mil (Net Equity – $470,000).

• Unlisted Securities: $700,000. These continue to generate $3,000 per month in passive income. While I don’t foresee significant appreciation in this asset, it functions well as a cash cow, consistently contributing to my cash flow.

Portfolio Updates and Investment Strategy

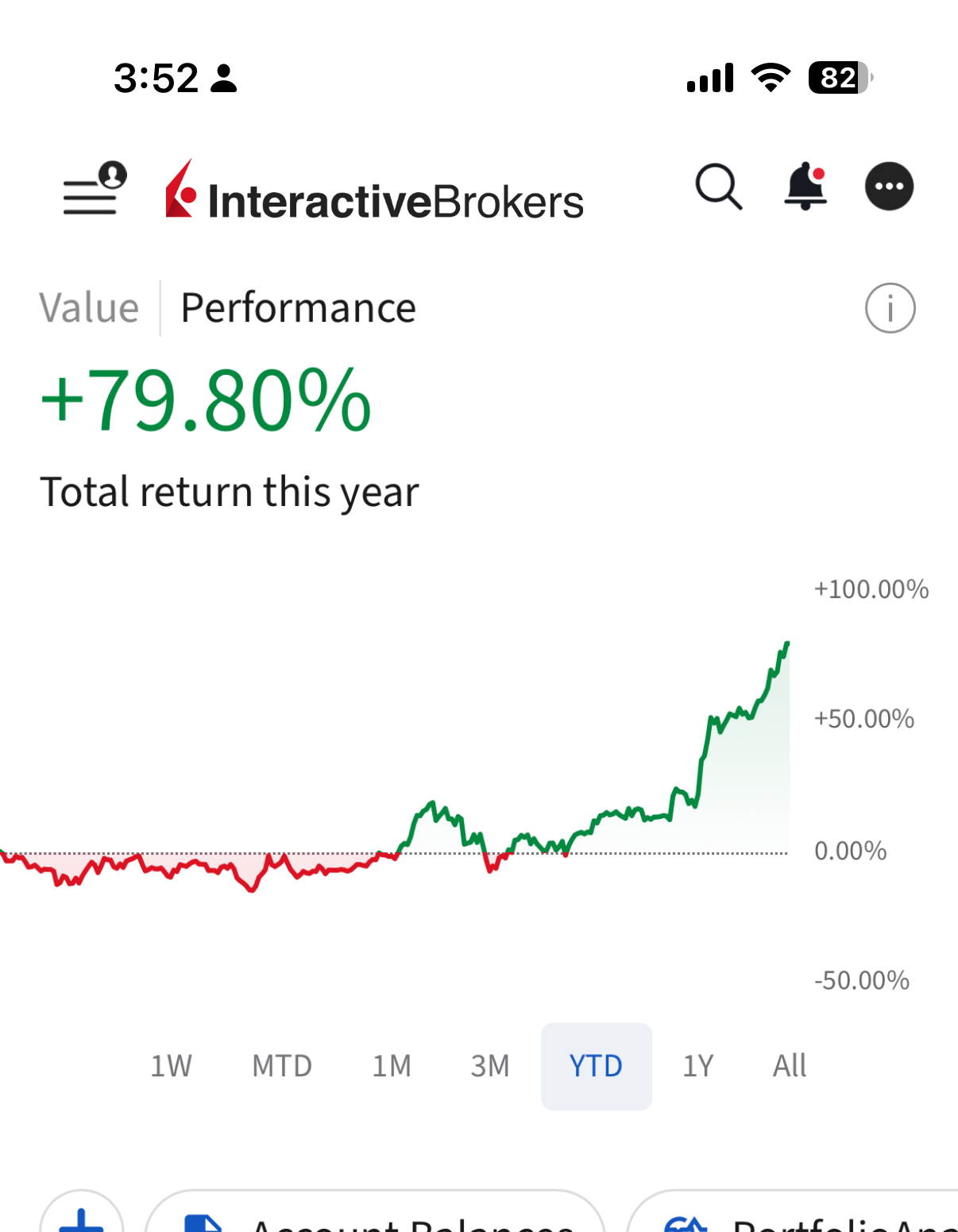

This year, my year-to-date portfolio return stands at 79.8%—a result I’m deeply thankful for. Such returns wouldn’t have been possible if I had followed a strategy of broad diversification. Instead, I’ve embraced the power of focus—allocating my resources to a few high-conviction investments that have the potential to deliver outsized gains.

In the past month, my portfolio grew by over $170,000, a surge largely driven by Tesla’s remarkable performance. While the growth has been extraordinary, I’m mindful of potential short-term challenges, such as weak sales in the US and Europe and recent concerns about Cybertruck demand. However, these headwinds do little to shake my long-term conviction in Tesla’s ability to innovate and lead in its industry.

Currently, Tesla, Shopify, and Palantir account for approximately 80% of my overall portfolio. These are the companies I deeply understand and believe in. The remaining 20% is distributed across other stocks that I’m still researching and monitoring, allowing me to maintain flexibility while refining my strategy. This disciplined approach has not only strengthened my portfolio but also reinforced my confidence in trusting my own research and decisions.

Property Update: A Plan for Rental Income

My property is nearing completion and is expected to be ready next year. Initially, I considered selling it to upgrade to a larger unit, but I realized that property is not within my circle of competence. Instead, I’ve decided to use it as a rental income source, with plans to rent it out in 2025.

This approach allows me to quickly build safe assets while channeling the rental income toward investments in high-conviction stocks. I believe this strategy has greater potential for outsized gains compared to property appreciation. It also aligns with my broader goal of optimizing cash flow and reinvesting in opportunities that can deliver exponential growth.

High-Conviction Investing: The Sniper Theory

https://www.pokecommunity.com/threads/one-...

https://www.pokecommunity.com/threads/one-...

When it comes to investing, I approach it like a sniper with only a handful of bullets—each shot must be deliberate, calculated, and well-planned. Imagine having just ten bullets to use in your entire life. Every detail matters: understanding the win condition, planning the escape route, and ensuring the shot is precise. This mindset forms the foundation of my high-conviction investing philosophy.

High-conviction investing requires focus and the ability to make decisions independent of market noise. For example, this year, Tesla’s stock experienced significant volatility, in part due to concerns over price cuts that raised questions about demand and margins. Analysts began downgrading the stock, and many investors were calling for a sell. It was a test of conviction—one that required me to trust my research, my judgment, and my belief in Tesla’s long-term potential.

Investing with conviction often means going against the grain. The bull is the herd. The bear is the herd. But the exceptional investor takes the lonely path. It’s about embracing discomfort and having the courage to hold firm when others are fleeing. Tesla’s price cuts, for example, weren’t simply a sign of weakness—they were part of a calculated strategy to secure market dominance, a perspective that many failed to appreciate.

This approach has reinforced my belief in the value of independent judgment. By focusing on fewer, carefully chosen stocks, I’ve been able to stay disciplined, confident, and resilient during market volatility.

Why I Have Conviction in Tesla

Tesla is more than just a car company—it’s a beacon of innovation, reshaping how we define value. Traditional value investors often approach Tesla like a conventional automaker, such as Ford or GM. Their models, rooted in old paradigms, judge Tesla’s worth through metrics like price-to-earnings ratios or delivery numbers, deeming it “overvalued.” But growth investors, like myself, see Tesla through a different lens—one that reveals its potential to breathe human-level intelligence into products, fundamentally altering their utility and significance.

As Elon Musk has pointed out, AI redefines the concept of value because it brings intelligence into previously static products. For Tesla, this means transforming cars from mere vehicles into intelligent robots capable of driving themselves, generating income as part of a robotaxi network, and making life more efficient. The difference is staggering: a Tesla with Full Self-Driving (FSD) is an asset that can work for its owner, while a traditional car is simply a depreciating liability.

This paradigm shift explains why Tesla, in my view, cannot be compared to legacy automakers—it’s in a league of its own. It’s not just a car company; it’s a leader in AI innovation that is redefining industries and reshaping the future of transportation and productivity.

Value vs. Growth Investing: Seeing the Bigger Picture

The gulf between value investors and growth investors lies in their focus. Value investors are tethered to the present, scrutinizing Tesla’s high price-to-earnings ratio or short-term challenges like delivery numbers. Growth investors, however, peer into the future, seeing Tesla not as a car company but as a harbinger of industrial disruption. Beyond automobiles, we see industries Tesla will transform: ride-hailing, logistics, energy, and even AI-driven productivity.

Earlier this year, Tesla’s stock plunged to $100, sparking panic and prompting analysts to downgrade their forecasts. For many, this was a moment of doubt. But as a growth investor, I saw a different story—a rare opportunity. The short-term noise from Wall Street was akin to static on a radio, obscuring the clear melody of Tesla’s potential. With conviction built on research and foresight, I added to my position, confident that Tesla was poised to redefine industries in ways traditional models can’t yet quantify.

A Redefined Concept of Value

Tesla’s Full Self-Driving and real-world AI are not just technologies—they are keys to a new frontier of productivity. If Tesla succeeds in solving FSD, every car becomes a robot on wheels, capable of navigating autonomously and generating income. This reimagining of a car’s role in daily life is why I believe Tesla is misunderstood. To those bound by traditional metrics, it appears overvalued; to those who see its potential, it is vision underpriced.

Tesla’s potential stretches far beyond transportation. It is a company building tools that will make life more efficient, industries more dynamic, and progress more exponential. It’s not just leading a revolution—it’s architecting a new era, one where products are no longer static but intelligent and alive with potential.

Taking Care of Health and Reflecting on Life

Beyond my financial journey, this year has also been about prioritizing my mental and physical health. I’ve come to deeply appreciate the saying, “health is wealth.” Achieving financial milestones is meaningless if I don’t have the health to enjoy them and live a fulfilling life. I’ve focused on eating well, staying active, and making time for self-care, ensuring that I’m building a strong foundation for the years ahead.

On a personal note, this has been a year of reflection and self-discovery, especially when it comes to personal relationships and personal growth. I’ve spent time understanding what truly matters to me—whether it’s fostering meaningful connections or aligning my life with my values and goals. This journey has reminded me to stay grounded, trust the process, and embrace the timing of life.

While there have been moments of uncertainty, they’ve also been opportunities to learn more about myself and what I’m looking for in the years to come.

Looking Ahead: A Special Year to Celebrate

This has been a special year—a year of growth, achievements, and lessons. To celebrate, I decided to splurge a little. I bought myself a Moncler Grenoble ski jacket and a new ski helmet in preparation for my upcoming ski trip to Hokkaido. I’ll be heading there in less than two weeks for some much-needed relaxation. Skiing has always been a passion of mine, and I’ve been practicing indoor skiing to ensure I’m in great condition for the trip.

This time away will also give me the chance to reflect on my progress and plan for 2025. It feels like the perfect way to end such a fulfilling year.

Final Thoughts

As I was wrapping up this blog post, a familiar melody floated through the air—a Christmas song playing outside my window. It reminded me that the season of giving and reflection is upon us, and with it, the close of another year. The music felt like a gentle nudge to pause, appreciate the moments that have passed, and look forward to the opportunities that lie ahead.

I want to take this opportunity to wish you a Merry Christmas and a Happy New Year. This time of year is perfect for reflecting on our journeys, celebrating our milestones, and setting intentions for the future. For me, it’s been a year of growth and learning, and I hope the same has been true for you.

What about you—how have your financial goals progressed this year? Have you started thinking about your aspirations for 2025? Whether you’re taking your first steps or already advancing steadily, I’d love to hear about your journey. Feel free to share your thoughts in the comments or reach out directly.

As we step into 2025, here’s to making it a year of new beginnings, meaningful progress, and fulfilled dreams. Let’s continue to grow, inspire, and celebrate every small and big win. Cheers to you, and may the holiday season bring you joy, peace, and prosperity!

$TSLA $SPY $SHOP $PLTR $NVDA $STI(STI.SI) $STI(^STI.IN)

$BITCOIN finally touches $100k. I can finally go to sleep now!

Original post: https://firebyforty.co/2024/12/04/breaking...

Google’s position as a tech giant is undeniable, but is it still the invincible powerhouse it once was? While this may not be a 10x investment opportunity for me, I find Google fascinating to analyze. Its business segments are uniquely structured, with each contributing differently to growth and profitability.

To better understand Google’s current position and future prospects, I’ve conducted a quantitative analysis to estimate its intrinsic value. This involves breaking down Google’s revenue into its core segments—Google Services (Google Search, YouTube Ads, & Google Network), Google Cloud, and Other Bets—and projecting their growth over the next four years. By using a sum-of-the-parts approach, I aim to uncover the company’s true worth in today’s competitive landscape.

Why a Napkin Math Approach?

For this analysis, I’ve deliberately chosen a Napkin Math approach to simplify the process. The rationale is twofold:

1. Accessibility: This method keeps the analysis straightforward and easy to follow, even for readers without a deep financial background.

2. Revisiting Made Easy: Simplified calculations make it easier for me (or anyone revisiting this analysis in the future) to understand the logic and assumptions without needing to sift through overly detailed models. This approach ensures that the analysis remains practical, actionable, and adaptable—key traits for any valuation exercise. Let’s dive in.

The Steps of the Analysis

To simplify the process, I’ve broken the analysis into five key steps:

- Breakdown and Segment Analysis: I begin by analyzing Google’s individual segments to project Q4 2024 revenue. This allows me to calculate the full-year 2024 financials as the baseline for future projections.

- 4-Year Revenue Projection: Using the FY 2024 financials and historical data, I project revenue for the next four years, applying growth rates that reflect the competitive and evolving landscape.

- Assigning Operating Multiples for 2028: For each segment, I assign an operating profit margin and valuation multiple based on its growth trajectory and profitability. This helps estimate the intrinsic value of each segment by the end of 2028.

- Discounting to Present Value: The 2028 valuation is brought back to the present value using an 8% discount rate, reflecting the time value of money and investment risks.

- Applying a Margin of Safety: Finally, I apply a margin of safety to account for uncertainties in the projections. This provides a conservative estimate of Google’s intrinsic value today.

With this framework in place, let’s begin by breaking down Google’s revenue segments and projecting Q4 2024 financials.

1. Breakdown and Segment Analysis

i. Google Search

This includes revenue generated from Google’s search engine, primarily through sponsored ads. Whenever users search on Google, sponsored results (displayed prominently at the top) drive significant ad revenue.

Google Search remains Alphabet’s largest revenue contributor. To project Q4 2024 revenue, I examined historical year-on-year growth rates. For example:

- Sep 23 vs. Sep 24: Revenue grew by 12% year-on-year, from $44,090 million in Q3 2023 to $49,385 million in Q3 2024.

- Similarly, Dec 23 vs. Dec 22: Revenue showed a comparable 12% growth year-on-year.

Using this consistent growth pattern, I applied a 12% year-on-year growth for Q4 24 compared to Q4 23, which had revenue of $48,025 mil.

Projected Q4 24 Google Search Revenue:

$48,025 million × 1.12 = $53,782 mil

ii. YouTube Ads

These are the advertisements you see while watching YouTube videos, whether as pre-roll ads, mid-roll interruptions, or discovery ads. In recent years, YouTube has significantly improved its monetization strategy, making ads a critical revenue driver.

YouTube Ads have also maintained a steady growth trajectory. Recent data shows:

- Sep 2023 vs. Sep 2024: Revenue grew by 12% year-on-year, similar to Google Search.

- Dec 2023 revenue: $9,200 mil.

Assuming a consistent 12% year-on-year growth, I project YouTube Ads revenue for Q4 24 as:

$9,200 million × 1.12 = $10,304 mil

iii. Google Network

The Google Network segment generates revenue from Google’s advertising ecosystem, specifically through platforms like AdMob, AdSense, and Google Ad Manager. This segment plays a vital role in connecting advertisers with content creators, including bloggers, app developers, and website owners.

How It Works

For content creators such as bloggers or website owners, Google Network provides tools to monetize their platforms by displaying ads. For example:

- Google AdSense: Allows bloggers and website owners to place Google advertisements on their sites. Revenue is generated when users view or click on these ads, helping creators earn income while continuing to publish content.

- Google Ad Manager: A tool for publishers to manage their ad inventory, optimize placements, and maximize ad revenue.

- AdMob: A platform designed for mobile app developers to monetize their apps through in-app advertising.

These services make it easier for creators to earn revenue while providing advertisers with targeted placement opportunities, ensuring a mutually beneficial ecosystem.

Q4 2024 Revenue Trends

Google Network revenue tend to have a strong seasonal boost in Q4, largely driven by increased advertising activity during the holiday season. Businesses ramp up their ad spend to capture consumer attention, especially for shopping and year-end promotions. This seasonal trend consistently results in higher revenue for Google Network during the final quarter of the year.

in millionsQ1Q2Q3Q4Yr 20216,8007,5977,9999,305Yr 20228,1748,2597,8728,475Yr 20237,4967,8507,6698,297Yr 20247,4137,4447,5488,500 (projected)Google Network’s Quarterly Revenue from 2021 to 2024

For Q4 23, Google Network generated $8,297 mil. Given the consistent seasonality and trends, I project a modest increase to $8,500 mil for Q4 24.

Total Google Advertising Revenue

Summing up the projections for Google Search, YouTube Ads, and Google Network, we get:

Google Search: $53,782 mil

YouTube Ads: $10,304 mil

Google Network: $8,500 mil

Total Projected Q4 2024 Advertising Revenue = $72,586 mil

iv. Google Others: Subscription and Beyond

The Google Others segment encompasses revenue from subscription-based services like YouTube Premium, Google One, and revenue generated through the . Unlike advertising, this segment focuses on direct-to-consumer revenue streams. For example:

- YouTube Premium Subscribers: People like me who subscribe to YouTube Premium contribute to Google Others revenue by paying for an ad-free experience.

- App Subscriptions via Google Play Store: Apps like Roblox generate revenue through in-app purchases or subscription such as Duolingo, from which Google takes a cut.

- Hardware Sales: Revenue from devices like Pixel phones and Nest products also contributes to this segment.

Growth Trends

Historically, Google Others has shown steady growth. Notably, the final quarter of each year tends to outperform the rest, likely due to:

- Seasonal Factors: Increased spending during the holiday season on hardware and apps.

- Subscription Uptake: A rise in new subscriptions for services like YouTube Premium and Google One.

For instance, in Dec 23, Google Others revenue grew by 29% q-o-q, from Q3 23 to Q4 23. This year, with Sep 2024 already outperforming Dec 2023, I project a more conservative 22% growth for December 2024, factoring in both subscription and hardware sales.

Q4 24 Revenue Projection

Sep 2024 (Q3 24) Revenue: $10,656 million

Projected Growth Rate: 22%

Projected Dec 2024 (Q4 24) Revenue:

$10,656 mil × 1.22 = $13,000 mil

Total Google Services Revenue

Now, let’s sum up the revenue for all components under Google Services:

Google Search: $53,782 mil

YouTube Ads: $10,304 mil

Google Network: $8,500 mil

Google Others: $13,000 mil

Total Projected Q4 2024 Google Services Revenue: $85,586 million

v. Google Cloud

Google Cloud: Driving Enterprise Growth

Google Cloud operates as a separate segment from Google Services, focusing on enterprise solutions and cloud infrastructure. Its revenue primarily comes from two sources:

- Google Cloud Platform (GCP):

A leading infrastructure and platform services provider, GCP is the largest driver of growth in this segment. It offers robust solutions for data storage, analytics, and AI model training, making it a preferred choice for large enterprises. - Google Workspace:

A suite of productivity tools including Gmail, Google Drive, and Google Docs, tailored for business and enterprise customers. This complements GCP’s offerings, making Google Cloud a comprehensive solution for businesses.

Key Customers

Google Cloud’s extensive client base includes some of the world’s biggest companies:

- Apple: Hosts iCloud user data on Google Cloud.

- Facebook, Intel, Yahoo, and Marriott: Among other notable clients that leverage Google’s cloud infrastructure.

Today, Google Cloud boasts close to 1 million enterprise customers, highlighting its competitive edge.

Market Position

Google Cloud is one of the three dominant players in the cloud industry, alongside Amazon Web Services (AWS) and Microsoft Azure. Its strong market position and comprehensive offerings make it a go-to platform for enterprises looking to leverage cloud computing and AI capabilities.

Q4 2024 Revenue Trends

Google Cloud has demonstrated consistent growth, not just year-on-year but also on a quarter-on-quarter basis. For Q4 2024, I project a 10% quarter-on-quarter growth, reflecting its steady momentum. Based on this:

Projected Q4 2024 Revenue:

$11,353 million × 1.10 = $12,488 million

vi. Other Bets

This category includes Alphabet’s experimental and long-term projects, such as:

- Waymo: Alphabet’s autonomous vehicle division.

- Venture Capital Investments: Includes stakes in innovative companies like SpaceX.

- Healthcare and Life Sciences: Managed through subsidiaries like Verily.

While these projects currently operate at a loss, they represent Alphabet’s commitment to innovation and have the potential to generate substantial value in the future.

While these ventures are innovative, they contribute minimally to Alphabet’s overall revenue. For Q4 2024, I estimate $300 million in revenue, consistent with historical trends where this segment has fluctuated between $200 million and $600 million.

Revenue Projection and Valuation Analysis

in millions(1) Rev for Q1-Q3 24(2) Rev for Q4 24P(1+2) FY 2024PGoogle Search144,05053,782197,832YouTube Ads25,67410,30435,978Google Network22,4058,50030,905Google Other28,70713,00041,707Google Cloud31,27412,48843,762Other Bets1,2483001,548Total Revenue ex.hedging gains/losses253,35898,374351,732

Having calculated Alphabet’s individual segment revenue for Q4 24, the next step is to project revenue growth for the subsequent four years. By assigning growth rates to each segment based on historical trends, market potential, and competitive dynamics, we can estimate Alphabet’s future revenue and determine its intrinsic value.

2. 4-Year Revenue Projection:

Google Services encompasses several subcategories, each with unique growth dynamics:

Google Search:

in millionsFY 21FY 22FY 23FY 24FRevenue148,951162,450175,033197,832y-o-y Growth %43% (vs 2020)9%8%13%

Projected Growth Rate: 8% year-on-year for the next four years.

Rationale: While Google Search has performed exceptionally in the past, the competitive landscape is evolving, particularly with the rise of large language model-based search engines. Although Google may maintain its superiority, I forsee that growth rate might slow due to increased competition

YouTube Ads:

in millionsFY 21FY 22FY 23FY 24FRevenue28,84529,24331,51035,978y-o-y Growth46% (vs 2020)1%8%14%

- Projected Growth Rate: 10% year-on-year.

- Rationale: YouTube continues to benefit from a strong network effect, with creators and advertisers still favoring the platform as the premier destination for video content.

Google Network:

in millionsFY 21FY 22FY 23FY 24FRevenue31,70132,78031,31230,905y-o-y Growth %37% (vs 2020)3%-4%-1%

- Projected Growth Rate: 7% year-on-year.

- Rationale: Steady growth is anticipated due to the consistent performance of platforms like AdSense, AdMob, and Google Ad Manager.

Google Others (Subscriptions & Hardware):

in millionsFY 21FY 22FY 23FY 24FRevenue28,03229,05534,68841,707y-o-y Growth %29%4%19%20%

- Projected Growth Rate: 15% year-on-year.

- Rationale: Strong growth is expected in subscription revenue (e.g., YouTube Premium, Google One) and hardware sales, supported by the increasing adoption of Google’s ecosystem.

Google Cloud is projected to experience substantial growth:

in millionsFY 21FY 22FY 23FY 24FRevenue19,20626,28033,08843,762y-o-y Growth %47%34%26%32%

- Projected Growth Rate: 30% year-on-year.

- Rationale: Google Cloud is a key growth driver, benefiting from its strong market position alongside AWS and Microsoft Azure. Increasing demand for AI and cloud-based solutions will likely fuel its expansion.

Other Bets is expected to grow at an aggressive rate:

in millionsFY 21FY 22FY 23FY 24FRevenue7531,0681,5271,548y-o-y Growth %15%42%43%1%

- Projected Growth Rate: 120% year-on-year.

- Rationale: While currently loss-making, Other Bets represents Alphabet’s long-term investments in innovative technologies like Waymo and Verily. As these projects mature, they may start contributing meaningfully to revenue.

3. Assigning Operating Multiples for each segment for 2028

Using the growth rates outlined above, here are the revenue and valuation projections for each segment by the end of the four-year period:

1. Google Services

FY 21FY 22FY 23FY 24Revenue237,529253,528272,543306,423Operating Profit Margin39%34%35%41%

Revenue (2028): $432 billion.

Operating Margin: 40% (reflecting economies of scale and operating leverage).

Valuation: Operating profit: $432 billion × 40% = $172.8 billion.

Assigned multiple: 15x operating profit.

Valuation: $172.8 billion × 15 = $2.59 trillion.

2. Google Cloud

in millionsFY 21FY 22FY 23FY 24FRevenue19,20626,28033,08843,762Operating Profit Margin-16%-10%5%19%

Revenue (2028): $124 billion.

Operating Margin: 25% (driven by economies of scale in infrastructure and AI services).

Valuation:Operating profit: $124 billion × 25% = $31 billion.

Assigned multiple: 30x operating profit.

Valuation: $31 billion × 30 = $0.93 trillion.

3. Other Bets

in millionsFY 21FY 22FY 23FY 24FRevenue7531,0681,5271,548Operating Profit Margin-701%-514%-268%–

Revenue (2028): $3.2 billion.

Operating Margin: 10% (as these projects begin to stabilize).

Valuation:Operating profit: $3.2 billion × 10% = $0.32 billion.Assigned multiple: 20x operating profit.

Valuation: $0.32 billion × 20 = $0.006 trillion.

Total Valuation (2028):

$2.59 trillion + $0.93 trillion + $0.006 trillion = $3.526 trillion.

4. Discounting to Present Value

To account for the time value of money, I applied an 8% discount rate to the total valuation. Using the formula for discounting, where:

r= 8% (discount rate)

n=4 years

Future Value=.3.526 T

Present Value Calculation:

3.526÷(1.08)4=2.59 T

5. Applying a Margin of Safety

Margin of SafetyIntrinsic Value0%2.59T10%2.33T20%2.07T30%1.81T

6. Final Thoughts on Google’s Future

In my view, Alphabet will remain a dominant force in the search engine space for years to come. However, the rise of AI-driven tools such as large language models (LLMs) and AI-based search engines will likely disrupt its core business. As users increasingly turn to AI for research, problem-solving, and content discovery, Google’s revenue from traditional search and advertising may face headwinds.

This changing landscape necessitates a more modest growth projection for Google Services, particularly for Google Search and YouTube Ads. While these segments may still grow, I anticipate a low-teens growth rate at best over the coming years.

The crown jewel of Alphabet, in my opinion, is Google Cloud. This segment is well-positioned to benefit from the explosion of AI and enterprise demand for cloud services. With its proprietary TPU chips and robust infrastructure, Google Cloud is not only growing rapidly but also improving its profitability through economies of scale. I believe Google Cloud will continue to be a key driver of Alphabet’s long-term growth and profitability.

7. Would I Invest in Alphabet?

While Alphabet is undeniably a strong and stable company, it doesn’t align with my personal investment strategy. At its current market cap of $2.1 trillion, and with a 20% margin of safety, Alphabet appears to be fairly valued. However, as an investor, I look for generational companies—businesses with a clear and probable path to achieving a 10x valuation over the next decade.

For Alphabet to achieve a 10x valuation, it would need to grow from $2 trillion to $20 trillion, which is an extremely challenging feat. The law of large numbers makes such exponential growth highly improbable, especially given increasing competition and the maturity of its core business segments. While Alphabet has the resources and leadership to defend its superiority, the likelihood of a 10x return seems slim in this case.

Instead, my focus is on companies with smaller market caps and high-growth potential, where I can see a clearer path to exponential growth. That said, Alphabet remains a safe investment for those seeking stability, backed by its dominant market position and diversified revenue streams. This analysis helps me understand how the market currently values big-cap companies like Alphabet and provides context for evaluating other tech giants.

Original Blogpost is here!: https://firebyforty.co/2024/11/17/50-to-fi...

As I sit down to write this blog post, I’m on the brink of turning 35 tomorrow. This moment marks a significant milestone in my journey toward achieving Financial Independence, Retire Early (FIRE) by the age of 40. With a current net worth of $2 million, I’ve reached 50% of my FIRE goal—but it hasn’t been an easy path.

I set this goal just before turning 31 during the COVID-19 lockdown. That period of reflection gave me the clarity to focus on building a solid financial foundation. Now, with five years left, I’m taking stock of my progress and planning my next steps to reach the finish line.

Sometimes, I can’t help but feel envious of those who are fortunate enough to earn significantly higher incomes. Their path to financial independence seems much smoother. For me, it’s different—I’ve had to work harder and be more strategic. My approach relies on 10x investing and disciplined savings. It’s about making the most of what’s available to me and staying focused on my goals.

By investing in high-growth opportunities and committing to a strict savings plan, I’m steadily progressing toward financial independence. It’s not always easy, but with resilience and determination, I’m hopeful that I can achieve FIRE by 40.

1. My Stock Portfolio: $724,000

US Portfolio WITH IBKR

US Portfolio WITH IBKR

SG Portfolio with POEMS

SG Portfolio with POEMS

In one of my earlier blog posts, I mentioned my commitment to simplifying my investment portfolio, inspired by Warren Buffett’s concept of a “20-punch card” approach. The idea is to limit my investments to a few high-conviction picks instead of diversifying into too many stocks. Over the past year, I’ve reduced the number of stock accounts I hold and streamlined my focus to just a few key positions.

At this point, Tesla has become the dominant force in my portfolio, accounting for around 50% of my total holdings. The recent meteoric rise in Tesla’s stock has been both exhilarating and challenging, as it reached new highs, partly driven by short covering, especially as it approached the $300 mark. This is followed by my positions in Palantir and Shopify.

Tesla: A Core Holding with Anticipated Catalysts

Tesla constitutes just over 50% of my stock portfolio, reflecting my strong conviction in its long-term potential. While the recent surge in its stock price has been exhilarating, I anticipate a short-term correction, which could present opportunities to increase my holdings at more favorable prices.

Looking ahead, several key developments are poised to drive Tesla’s growth:

• Full Self-Driving (FSD) Version 13: Tesla is expected to release FSD V13 to internal testers by the end of this week, with a public rollout targeted around Thanksgiving.This update aims to enhance autonomous driving capabilities, moving closer to unsupervised Full Self Driving.

• Affordable Vehicle Launch: Tesla is anticipated to introduce a low-cost vehicle, broadening its market reach and making electric vehicles more accessible.

• Shanghai Megapack Production: The Shanghai Megafactory is on track to begin shipping Megapacks in Q1 2025, with an initial capacity to produce 10,000 units annually, significantly boosting Tesla’s energy storage capabilities.

• Tesla Semi and Cybertruck: The completion of the Tesla Semi and the continued strong sales of the Cybertruck are anticipated to further enhance Tesla’s product lineup and market presence.

These are just a few of the reasons I believe Tesla’s future remains incredibly promising. However, to keep this post focused on my overall financial journey, I plan to write a separate, in-depth post diving into why I’m so invested in Tesla and its long-term vision.

Palantir: The Rising Second Pillar

The second largest holding in my portfolio is Palantir. I’m bullish on the company, particularly its AI Platform (AIP), which I see as the crown jewel of its offerings. However, I’ll admit that Palantir is not the easiest company to fully grasp—there’s a lot happening beneath the surface that requires a deeper understanding. While I believe in its potential, this lack of comprehensive insight has made me hesitant to allocate as much capital to Palantir as I have to Tesla.

That said, Palantir’s performance has been nothing short of impressive. My investment in the stock has already grown fivefold—a result I honestly wish I had seen with Tesla instead. Moving forward, I’m keen to dive deeper into Palantir’s AIP, especially given its potential to transform various industries.

Shopify: Empowering the Backbone of Commerce

My third conviction stock is Shopify, a company that likely needs no introduction. While historically focused on the B2B space, Shopify is increasingly moving into the B2C segment, especially with its innovations in payment solutions. What I admire most about Shopify is its relentless drive to empower small businesses. Toby Lütke, Shopify’s founder, along with his team, has remained laser-focused on innovation, consistently pushing new products and services that help small businesses thrive both online and offline.

Shopify’s ability to adapt and innovate in a rapidly changing market is what makes it stand out for me. It’s not just about building an e-commerce platform anymore—it’s about creating an ecosystem where entrepreneurs can succeed, whether they’re setting up shop online or expanding into brick-and-mortar spaces.

2. Crypto: $60,700 in Bitcoin and Ethereum

Screenshot

Screenshot

In terms of cryptocurrencies, I’ve kept my focus on the two main players: Bitcoin and Ethereum. I started exploring crypto back in 2020, purchasing these in tranches of about $1,000 whenever I have excess funds to allocate. I view crypto as a hedge against inflation and a store of value.

Bitcoin, in particular, appeals to me due to its unique property of true ownership. When you control your private keys (seed phrase), no central authority can seize your assets. This concept of decentralized ownership is what makes Bitcoin so powerful, in my opinion. While I remain more bullish on Bitcoin than Ethereum, I’m still interested in exploring new crypto projects, particularly those focused on AI. However, due to time constraints, I haven’t been able to dive deeply into these projects yet.

Despite my cautious approach, my investments in Bitcoin and Ethereum have paid off handsomely, delivering over 50% returns in the past two years.

3. Real Estate: Property Value - $1.29 Million (Net Equity - $470,000)

Two years ago, I purchased a property valued at $1.29 million. This property is expected to be completed next year and is projected to generate rental income of around $3,500 per month.

However, I still have an outstanding mortgage of $820,000, which affects the net value. If we consider the mortgage, my current net equity in the property stands at around $470,000. My strategy moving forward is to aggressively pay down this loan using my CPF contributions and passive income to increase my equity over time.

For now, I’m undecided on whether to keep this property as a rental or sell it to purchase a larger unit. Much of this decision will depend on the state of the property market. However, I’m leaning towards holding it for rental income to avoid tapping into my stock portfolio for a new purchase.

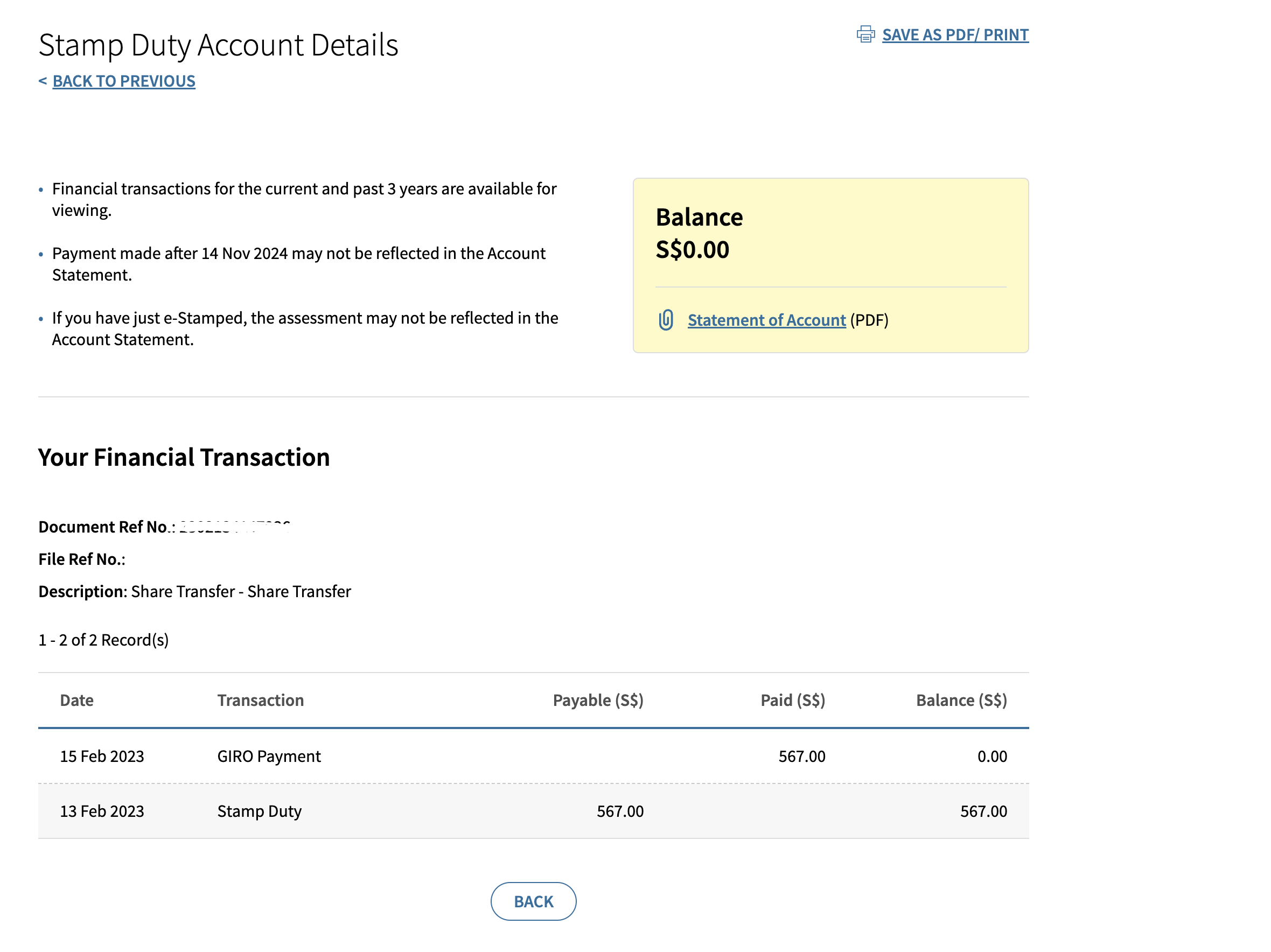

4. Private Investment in an Unlisted Company - $700,000

About a year ago, I took the opportunity to acquire shares of an unlisted company, which has since become a reliable source of passive income. This investment yields approximately $3,000 in dividends every month, translating to around $36,000 annually. Given that this is a form of ownership in the company, I receive dividends on a yearly basis rather than monthly disbursements.

The current valuation of this private investment is about $700,000, making it one of the more stable assets in my portfolio. It provides a consistent income stream, especially valuable during uncertain market conditions. However, due to the nature of my work, I can’t actively participate in the company’s operations as it presents a potential conflict of interest. As a result, my role is purely as a passive shareholder—essentially a “sleeping partner” who collects dividends without direct involvement.

5. SRS Contributions - $55,000

In addition to my stock portfolio, I’ve been diligently contributing to my Supplementary Retirement Scheme (SRS) over the past three years. For those unfamiliar, the SRS is a tax-deferred scheme in Singapore that allows you to contribute up to $15,300 annually. By doing so, you receive a tax deduction on that amount. The funds remain tax-deferred until the age of 65, at which point withdrawals are taxed at only 50% of the regular tax rate.

I’ve been maximizing my SRS contributions each year to take advantage of these tax benefits. Currently, my SRS portfolio is focused on the S27, which is the S&P 500 index fund listed on the Singapore Stock Exchange. So far, this strategy has been performing well, with the current portfolio value standing at approximately $55,000. This diversified exposure to the U.S. stock market has provided steady growth, aligning with my long-term FIRE goals.

Total Net Worth Calculation for 2024

After detailing my various assets, here’s a summary of how it all adds up. To keep things simple, I’ve excluded CPF, unit trusts, insurance, and emergency cash from this calculation. The focus here is solely on my core investment assets:

- Stocks (Tesla, Palantir, Shopify, etc.): $724,000

- Real Estate (Net Equity): $470,000

- Private Investment in Unlisted Company: $700,000

- SRS Contributions: $55,000

- Cryptocurrencies (Bitcoin and Ethereum): $60,700

Total Net Worth for 2024: $2,009,700

Reflecting on My Financial Journey

Based on these figures, my current net worth stands at approximately $2 million. I’m thankful that I’ve managed to achieve more than half of my goal, with five years left to reach my target. While market volatility is always a concern, I’m prepared for whatever the next five years may throw at me. As the saying goes, “What doesn’t kill you makes you stronger.” I’ve certainly experienced my fair share of emotional and financial ups and downs.

Despite these challenges, I’m reminded of the words in Philippians 4:6: “Do not be anxious about anything.” This verse has been a constant source of comfort during tough times, encouraging me to stay grounded and focused on my long-term objectives, no matter the short-term market swings or personal struggles I encounter.

Reflecting How Far I Have Come

As I sit here reflecting, I’m filled with gratitude for how far I’ve come on this journey. It feels like just yesterday when I was a student, about to graduate at 25, writing my first few blog post to celebrate reaching a net worth of $100,000. Here it is: https://firebyforty.co/2015/04/10/my-sg-portfolio/ At that time, it felt like a huge milestone, one that I was incredibly thankful. But if you had told me then that, nine years later, I would be sitting here with a net worth of $2mil, I might not have believed it.

The journey hasn’t been easy. Those early years were challenging, to say the least. Saving that first $100,000 was a significant hurdle—it required patience, discipline, and the willingness to delay gratification. I remember starting out in my career, trying to save every dollar while navigating the demands of a new job. There was one rainy day that I’ll never forget. I was rushing to a client meeting, feeling motivated and ready, when a sports car sped through a huge puddle, splashing water all over my face. I had to go into that meeting soaked, trying to keep my composure. Moments like that reminded me that the road to financial independence is rarely smooth, but it’s these experiences that build resilience.

This past year has been one of significant growth. As my stock portfolio appreciated, especially in the final weeks with Tesla’s run and gains in my crypto holdings, I felt the momentum picking up. But with that growth came the realization that I haven’t been as disciplined with my savings as I used to be. I indulged a bit—upgrading gadgets, splurging on a high-end jacket, and even treating myself to business class flights. These purchases brought temporary joy but also made me reflect on what truly adds value to my life.

Looking back now, I can see how every step—no matter how small—has contributed to where I am today. It hasn’t been easy, but it’s been worth it. For those who are still working towards financial independence, my advice is simple: Stay committed and keep pushing forward. The first milestones may feel like they take forever, but once you gain momentum, it gets easier. Every effort you put in now brings you closer to your goal.

I’m thankful for the journey—both the highs and the lows. They’ve shaped me into who I am today, and I’m excited to see what the next five years will bring.

The Department of Kelvin’s Financial Efficiency

Inspired by Elon Musk’s “Department of Government Efficiency” (better known as DOGE), I’ve decided to create my own Department of Kelvin’s Financial Efficiency for the upcoming year. This means being more intentional about where my money goes, simplifying my expenses, and focusing only on hobbies that truly bring me joy. Instead of being a jack-of-all-trades, I plan to streamline my activities to focus on what matters most—like skiing, which I genuinely enjoy.

The goal is to optimize my budget, reduce unnecessary spending, and free up time to dive deeper into investments. This includes researching stocks and exploring promising crypto projects. My interest lies in stocks with the potential to achieve a 10x return in 10 years, so if anyone has ideas or would like to connect, I’m always open to new insights.

By practicing financial discipline now, I can free up more resources to invest in areas that truly move the needle toward my FIRE goal. This approach will help me align my investments with my long-term vision.

The Plan for the Next Five Years: Saving and Investing

Moving forward, my plan is to save $12,000 per month from my salary, totaling $144,000 per year. Over the next five years, this will amount to $720,000 in contributions. Assuming a 10% annual return, I could potentially grow this to around $1 million.

In addition to disciplined savings, I’m counting on my existing assets to appreciate further. My goal is to leverage my current portfolio and real estate investments to generate the remaining growth needed to achieve my FIRE target. By combining disciplined savings with investment returns, I believe I can generate an additional $1 million through market appreciation, bringing my total to the $BAMM

This journey won’t be without its challenges, but by staying focused and making smarter financial decisions, I’m confident that I can reach my goal. Here’s to the next chapter of disciplined investing and financial efficiency!

A Commitment to the Next Chapter: Pursuing FIRE by 40

As I move into this next phase of my life, I am more committed than ever to reaching my FIRE goal. I have five years left, and while the road may not always be smooth, I am ready to face whatever challenges come my way. My focus will be on staying disciplined, simplifying my life, and investing in what truly matters—both financially and personally.

The journey to FIRE isn’t just about accumulating wealth; it’s also about growing as a person, learning from past mistakes, and building a life that aligns with my values. It’s about finding meaning in the choices I make, whether it’s saving, investing, or deciding how I spend my time.

Lately, a song that has been on my mind is Eason Chan’s 陀飛輪 (YouTube link here). The lyrics of this song resonate deeply with my pursuit of financial independence. The song reflects on the idea that chasing material wealth—like the luxury watch —often leads people to lose sight of what truly matters in life. It’s a reminder that, while achieving FIRE is important to me, it’s not just about the money. It’s about using financial freedom as a tool to live a meaningful life.

The lyrics serve as a powerful metaphor, urging listeners to reflect on their motivations. The pursuit of wealth can sometimes feel like chasing after an expensive watch: impressive on the surface but ultimately not what brings lasting fulfillment. For me, reaching FIRE isn’t about the flashy milestones but rather about gaining the freedom to focus on what truly enriches my life—time with loved ones, personal growth, and living according to my values.

Here’s to embracing the journey, staying grounded, and not losing sight of what truly matters as I continue towards financial independence by 40!

https://www.youtube.com/watch?v=URUIcYDq3_I

How About You?

I’ve shared my journey towards financial independence—celebrating the highs, learning from the lows, and staying committed to my goals. But I’d love to hear from you. How’s your journey going? What are your own milestones, challenges, and lessons learned? Let’s continue the conversation and inspire one another to keep pushing forward toward our dreams.